No state has ended personal income taxes since 1980, but Mississippi and Kentucky may change that

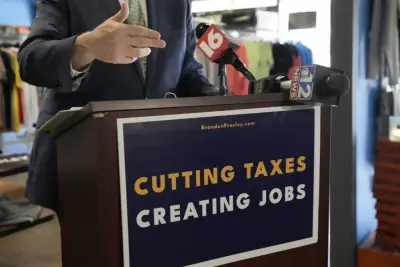

About years have passed since a U S state last eliminated its income tax on wages and salaries But with up-to-date actions in Mississippi and Kentucky two states now are on a path to do so if their economies keep growing The push to zero out the income tax is perhaps the the greater part aggressive example of a tax-cutting trend that swept across states as they rebounded from the COVID- pandemic with surging revenues and historic surpluses But it comes during a time of greater uncertainty for states as they wait to see whether President Donald Trump s cost cutting and tariffs lead to a reduction in federal funding for states and a downturn in the overall commercial sector Particular fiscal analysts also warn the repeal of income taxes could leave states reliant on other levies such as sales taxes that disproportionately affect the poor Which governments charge income tax The th Amendment to the U S Constitution grants Congress the power to levy income taxes It was ratified by states in Since then the greater part states have adopted their own income taxes Eight states presently charge no personal income tax Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas and Wyoming A ninth state Washington charges no personal income tax on wages and salaries but does tax certain capital gains income over When Alaska repealed its personal income tax in it did so because state coffers were overflowing with billions of dollars in oil money Though income tax eliminations have been proposed elsewhere they have not been achieving It s a lot easier to go without an individual income tax if you ve never levied one commented Katherine Loughead a senior analyst and research manager at the nonprofit Tax Foundation But once you become dependent on that revenue it is a lot more complicated to phase out or eliminate that tax What is Mississippi doing Republican Mississippi Gov Tate Reeves in recent months signed a law gradually reducing the state s income tax rate from to by and setting state revenue rise benchmarks that could trigger additional incremental cuts until the tax is eliminated The law also reduces the sales tax on groceries and raises the gasoline tax If cash reserves are fully funded and revenue triggers are met each year Mississippi s income tax could be gone by Supporters of an income tax repeal hope it will attract both businesses and residents elevating the state s financial system to the likes of Florida Tennessee and Texas Their theory is that when people pay less in income taxes they will have more money to spend thus boosting sales tax collections The tax repeal puts us in a rare class of elite competitive states Reeves declared in a report He added Mississippi has the expected to be a magnet for opportunity for capital for talent - and for families looking to build a better life Mississippi is among the bulk impoverished states and relies heavily on federal funding Democratic lawmakers warned the state could face a financial crises if cuts in federal funding come at the same time as state income tax reductions The income tax provides a huge percentage of what the state brings in to fund things like schools and robustness care and services that everybody relies on disclosed Neva Butkus senior analyst at the nonprofit Institute on Taxation and Economic Program What has Kentucky done A Kentucky law reduced the state s income tax rate and set a series of revenue-based triggers that could gradually lower the tax to zero But unlike in Mississippi the triggers aren t automatic Rather the Kentucky General Assembly must approve each additional decrease in the tax rate That has led to a series of tax-cutting measures including two new laws this year One implements the next tax rate reduction from to starting in The second makes it easier to continue cutting the tax rate in the future by allowing smaller incremental reductions if revenue increase isn t sufficient to trigger a percentage point reduction Democratic Gov Andy Beshear signed the ordinance for next year s tax cut but let the other measure passed by the Republican-led legislature become law without his signature Beshear called it a bait-and-switch bill contending lawmakers had assured the guardrails for income tax reductions would remain in place while pushing for the tax cut then later in the session altered the triggers for future years What actions have other states taken New Hampshire and Tennessee already did not tax income from wages and salaries but both states had taxed certain types of income In Tennessee ended an income tax on interest from bonds and stock dividends that had been levied since New Hampshire halted its tax on interest and dividends at the start of this year Several other states also are pushing to repeal income taxes The Oklahoma House passed law in March that would gradually cut the personal income tax rate to zero if revenue expansion benchmarks are met That bill now is in the Senate New Missouri Gov Mike Kehoe a Republican also wants to phase out the income tax The House and Senate have advanced ordinance that would take an incremental step by exempting capital gains income from taxes Source